Rugby Finances

-

I don't see England's tests against NZ, Arg and Aust happening if the July tests in the SH are cancelled. SANZAAR nations will prefer to have some sort of RC in that Nov window if international travel is permitted to provide them with home tests and revenue themselves.

-

@gt12 said in Rugby Finances:

whats the ownership structure of the RFU? We’re I a British taxpayer, I’d be asking for an ownership stake or shares in key assets and/or competitions if I were hit up to bail them out.

I'd assume it would be a loan rather than a bailout.

The UK government have just given the RFL a £16m loan.

-

@Bovidae said in Rugby Finances:

I don't see England's tests against NZ, Arg and Aust happening if the July tests in the SH are cancelled. SANZAAR nations will prefer to have some sort of RC in that Nov window if international travel is permitted to provide them with home tests and revenue themselves.

I think its quite safe to assume there won't be any inter-hemispheric test rugby this year.

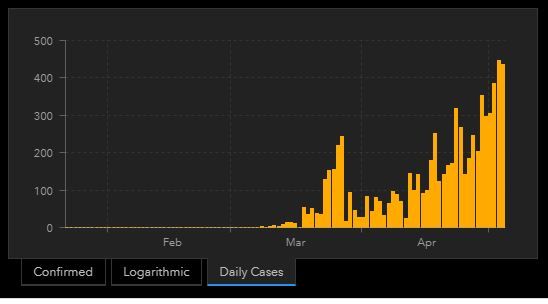

There will likely be no test rugby at all, maybe only NZ v Aus if the trans-tasman bubble comes into being.South Africa aren't on the right carona-curve trajectory, there will be no TRC.

Unfortunately, this them at the end of their just-loosened lockdown.

-

Speaking of South Africa and finances:

-

From the article linked further up ^

“Twickenham is a major asset for us. Compared to the southern hemisphere, most of those unions don’t own their own stadiums. We tend to own stadiums in the northern hemisphere. When you own a stadium it is a major cost, but you can generate a tremendous amount of revenue from that. Hence the importance of the autumn internationals taking place in November

The whole, build a bigger stadium jibe, is showing the other side now. It come with costs and risks.

The whole reason revenue-sharing extra November tests came into being was because in the early 2000s the WRU were about to go bankrupt under their Millenium Stadium debt.

While bankruptcy is not a risk for the RFU under normal circumstances, They have borrowed £80m to re-develop their Twickenham East Stand (which was only 25 years old). As of last financial report they had reduced that debt to £60m already, paying off an incredible £15.2 million in a year ..... (while needing to cut funding to the Championship and the community game, however).

But with the following year beign a RWC years they expected to make a loss, this year expected to be a bumper year with the 4th November international.

https://www.sportspromedia.com/news/rfu-england-rugby-profit-revenue-2018-19

From: December 5 2019The Rugby Football Union (RFU), the game’s governing body in England, is back in profit for the 2018/19 financial period having banked UK£14.9 million (US$19.6 million), a dramatic turnaround on the UK£24.4 million (US$32.1 million) losses posted the previous year.

Overall, profits before rugby investment jumped 39 per cent year-on-year to UK£115.4 million (US$151.5 million).

The RFU’s latest annual filing also reveals revenues of UK£213.2 million (US$280.1 million), up UK£40.8 million (US$53.5 million) on the previous year.

The upturn in the RFU’s financial fortunes have been credited to stronger sponsorship revenues, more international matches played at Twickenham stadium, a reduction in overall rugby investment and lower overheads. At the end of the year, outstanding bank loans totalled UK£59.5m (US$78.2 million), down UK£15.2 million (US$19.9 million).

In focus, sponsorship revenue increased from UK£29.3 million (US$38.4 million) to £32.8 million (US$43.1 million), helped by IBM, Unilever and CBRE all renewing their partnerships with the RFU. New deals were also signed with the likes of British Airways and Majestic Wine.

Twickenham, the largest rugby union-dedicated stadium in the world, helped bring in more revenue, with ticket income leaping 59 per cent to UK£47.6 million (US$62.6 million) and broadcast takings increasing 21 per cent to UK£49.7 million (US$65.2 million)

Merchandising and licensing also saw a healthy rise of 44 per cent to UK£4.5 million (US$5.8 million).

In addition, the financial figures point to a significant severance package for chief executive Steve Brown. Total remuneration for the full senior management team, inclusive of social security costs, was UK£2.9 million (US$3.7 million), UK£400,000 (US$525,000) more than last year. Brown announced his resignation in November 2018 after only 14 months in the role following mounting criticism over the RFU’s increasing losses.

Andy Cosslett, the RFU’s chairman, said: “Maintaining the Union’s financial stability requires prudent planning, financial discipline and, when necessary, strong action to be taken on costs. Over the past two years we have felt it necessary to take such action in response to revenues falling short of some ambitious forecasts and a more uncertain outlook.

“Parts of the game that rely on our financial support and many RFU departments were asked to cut back. While this work has been difficult and presented challenges, investment levels in the game remain high. During the year, the RFU invested £100.5 million (US$132.1 million) [2018: £107.7 million or US$141.4 million] in the game, and the financial position of the Union has strengthened.”

RFU chief executive Bill Sweeney added: “Twickenham Stadium generates 85 per cent of our revenues to invest in the game at both the performance and community levels. We welcomed 1.2 million people across 22 major events during the year and the East Stand, which opened for the autumn’s Quilter Internationals, brought excellent feedback and added to the stadium’s status as a world-class venue.”

The RFU added that the organisation faces a Rugby World Cup year loss in 2019/20 for the first time in eight years, due to no Twickenham autumn internationals.

-

Cancelled autumn and Six Nations Tests would cost WRU £50m of revenue

-

Interesting that Top 14 apparently dont have option to cut wages.

Clubs in France still bear weightier financial responsibilities to their employees than English clubs. “French law doesn’t enable clubs to do what British law does,” Gillham adds. “Clubs in England have just cut salaries by 25 per cent – Newcastle stopped paying anybody. That’s not possible in France.”

That is from 08/04 ^

Also in that article, these paragraphs:One possibility may be interest-free or low-rate loans to clubs, but whatever lifeboat options are finally agreed, Gillham said that the LNR will honour its commitments, and that it has strong support from its partners, including pay-TV broadcaster Canal Plus, which has a better current relationship with French rugby than football.

It recently held back a scheduled €110million payment for broadcast rights to French football’s Ligue 1.

“This is the perfect example of force majeure,” a spokesman told AFP at the time. “There are no more matches, so there are no more payments. We are strictly applying the terms of the contract and we don’t see why we would do it any other way. Canal Plus is not a bank.”

Gillham said Canal, which is also paying €97million a season for Top 14 broadcasting rights, will remain a strong partner for the sport.

“Canal Plus loves rugby,” he said. “Canal Plus thinks it gets value for money from rugby. And Canal Plus is a partner until at least 2023. The TV money is not going to go away,” Gillham, who sits on the management board of the broadcaster’s parent company, Vivendi, said.

6 days later on 14/04:

French pay-television broadcaster Canal Plus will not pay the final rights fee instalment for this season’s Top 14 rugby union competition, it has been reported.

The move comes despite expectations in some quarters that the broadcaster’s strong relationship with rights-holder Ligue National de Rugby would ensure the fee was met.

Canal Plus was next month due to pay the remaining 15 per cent of its €97m ($104.5m) fee for the 2019-20 season, but this will no longer happen, reports L’Équipe.

The broadcaster had shown 60 per cent of matches before the league was suspended due to the Covid-19 pandemic. Canal Plus has already paid 85 per cent of the annual fee (€82.5m), suggesting that, in theory, it could push for a re-imbursement of around €24.3m from the LNR.

-

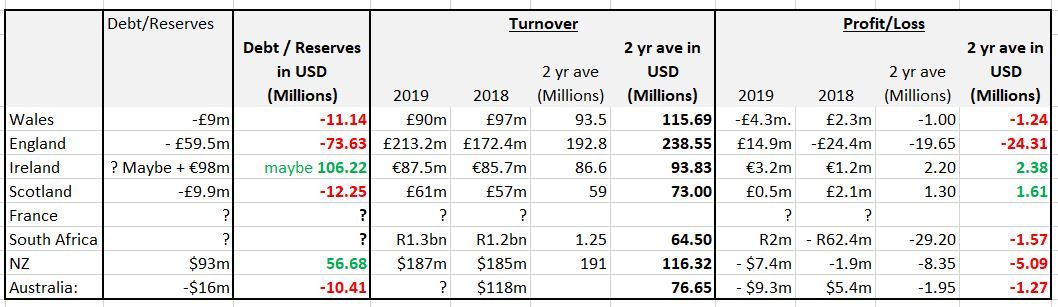

I've made this table of the financial positions going into the crisis for the 8 major unions, supporting, or subsidising professional rugby.

Lots of various factors in play though. For example

- For Ireland - do they fund their entire professional game pretty much from $USD93.83m. How much provinces revenue and spending is separate from this?

- England 'only' fund UK£25.5m per year in grants to the 13 Premiership clubs, which is $USD27.64m out of a 2 year average of $USD238.55m in revenue.

-

@Crucial said in Rugby Finances:

How did Ireland build such big reserves?

I remember that NZ created a big pot some years ago with smart currency futures on sponsorship (or something similar). Ireland's one surely can't just be from operating profits.I think it's pretty obvious how!

-

@Crucial said in Rugby Finances:

How did Ireland build such big reserves?

I remember that NZ created a big pot some years ago with smart currency futures on sponsorship (or something similar). Ireland's one surely can't just be from operating profits.I put a "maybe?" for their one.

Its hard to read different types financial reports and know if its the same thing.

Ireland is here, if you want to look: https://www.irishrugby.ie/irfu/annual-report/BTW, the ARUs reporting is farking hard to find and read. No idea what their revenue is unless a media outlet reports it. No wonder they are farked .....

-

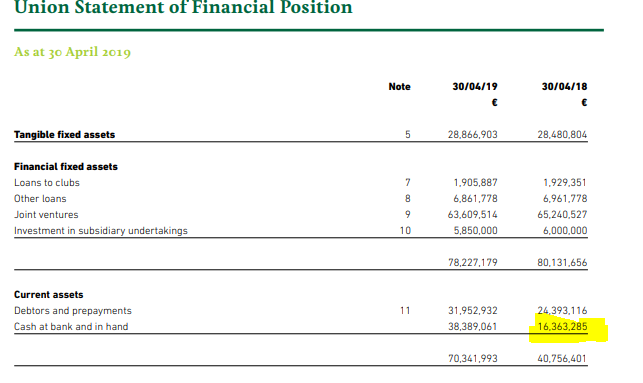

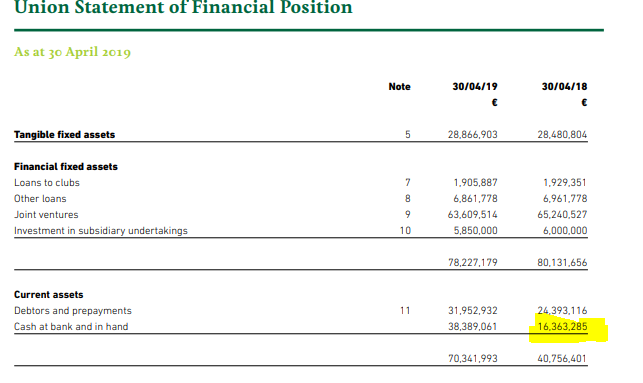

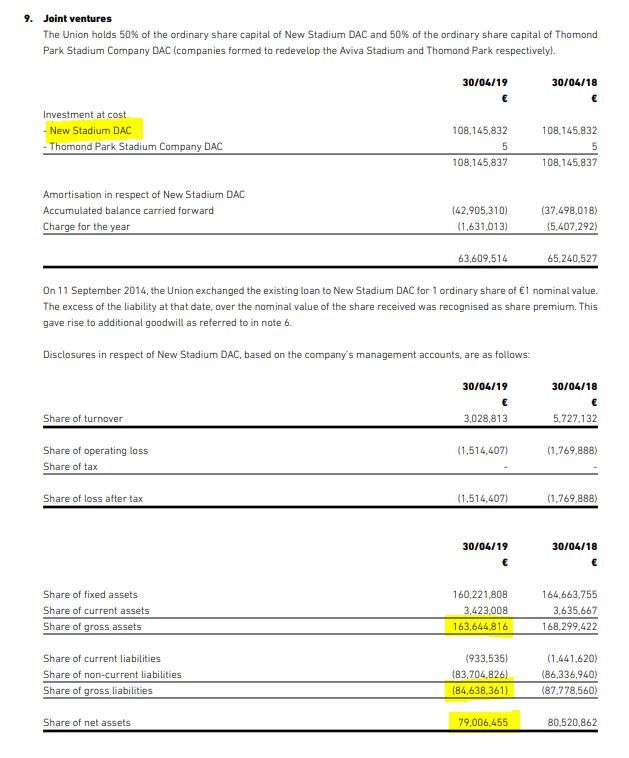

The majority of their money is stuck in loans (I guess to sub unions, they won't be getting that back in a hurry) and joint ventres. They have 38 million of cash (highlighted wrong year, sorry). The IRFU is doing bloody well for itself, a lot powered a Schmidts conquering ABs etc, they were on a high here!

-

@Machpants said in Rugby Finances:

The majority of their money is stuck in loans (I guess to sub unions, they won't be getting that back in a hurry) and joint ventres. They have 38 million of cash (highlighted wrong year, sorry). The IRFU is doing bloody well for itself, a lot powered a Schmidts conquering ABs etc, they were on a high here!

Iirc they had to bail out Munster and their Thomomd redevelopment debt. So, that is probably mostly in a loan to Munster.

Edit.

Actually only €6.86 million left (Original 2007 a loan of 11.5 million euro)

Here: https://www.the42.ie/thomond-park-naming-rights-munster-4736154-Jul2019/A loan from the national union helped the southern province to redevelop the Limerick stadium in 2007/08.

There have been struggles for Munster to repay that debt in recent years, although a €2.6 million payment in 2017/18 helped the province to reduce the total owed to its current €6.86 million.

The 2017/18 season also saw the province renegotiate its schedule of loan repayments with the IRFU, reducing their scheduled repayments down from €500,000 to €100,000 per year.

The new deal also means that the IRFU will receive 50% of Munster’s multi-year ticket sales, 50% multi-year corporate box sales, as well as 50% of any Thomond Park naming rights income on an annual basis.

-

Doesn't the IRFU have Aviva Stadium as an asset?

-

@antipodean said in Rugby Finances:

Doesn't the IRFU have Aviva Stadium as an asset?

Yes, but not 100% anymore like when it was Lansdowne Road. Own 57.5%

The Irish Rugby Football Union (IRFU) has dismissed reports that it could secure full control of Aviva Stadium amid the Football Association of Ireland’s (FAI) financial troubles, stating its investment plans are focused on the development of the sport.

The prospect of the IRFU taking over the FAI’s 42.5-per-cent stake in the Dublin venue emerged this week after the true extent of the latter body’s financial travails was revealed, including a request for an €18m ($19.7m) bailout from the Irish government.

Aviva Stadium is owned by New Stadium DAC, a company in which the IRFU holds a 57.5-per-cent interest alongside the FAI’s stake. Both organisations have two representatives each on the company’s board of directors.

The IRFU met yesterday (Thursday) with the Irish government’s Department of Transport, Tourism and Sport to discuss the operations of New Stadium DAC.

The union told the Irish Times newspaper: “To address recent speculation, the IRFU confirms that it does not have an interest in acquiring the FAI’s share in the Aviva Stadium.”

“The IRFU’s investment programme is centered firmly on the development of rugby at all levels and all available funds are fully committed to that programme.”

It is reported that the FAI and IRFU currently pay a licence fee of around €200,000 per month apiece to help cover the running costs of the stadium. However, the FAI is said to have fallen behind in its payments by the equivalent of six months, or €1.2m.

Irish public broadcaster RTE added that the FAI retains a debt of €29m on the stadium, with reports ahead of yesterday’s meeting stating that the IRFU could take over this debt in return for the FAI’s stake in the facility.

The 52,000-seat Aviva Stadium opened in May 2010, replacing Lansdowne Road as home of the Irish rugby union and football teams. Developed at a cost of €460m, the government’s contribution of €191m means it has the right to overrule any potential change in ownership.

The The total cost of building the Aviva was €411m, out of this, the Government injected 191m of the taxpayer’s money, and the remaining amount, €220m, is to be paid by the co-owners of the stadium, the IRFU and the FAI.

Aviva (New Stadium DAC) reported in this part here.

In accountancy speak, does that mean their 57.5% share is worth €163m, debt owing is €84m, so net asset is €79m

-

Not sure if this has been posted anywhere, but this seems a logical place.

https://www.nzherald.co.nz/sport/news/article.cfm?c_id=4&objectid=12330421

Sorry link doesn’t seem to be pasting properly...

Canal Plus ‘won’t pay’ final Top 14 rights fee instalment

Canal Plus ‘won’t pay’ final Top 14 rights fee instalment