-

-

@nepia restaurants are partly the stupid roller coaster hospitality has been on during the pandemic.

Our weekly grocery bill has been creeping up from the high 200s a few years back to regularly high 300s now. Partly that's my wife not understanding that it's perfectly ok to buy less than 500 tonnes of meat every week. She's Italian

-

Wheat cash contract in the last month (around 40% increase)

Oil since beginning of year (around 50% increase)

Whether these trends are permanent or not is the worrying thing.

The world won't like 150 dollar barrel oil or more.(images from my trading charts)

-

Wheat cash contract in the last month (around 40% increase)

Gee I wonder what could have possibly happened in the last month that would do such a thing?

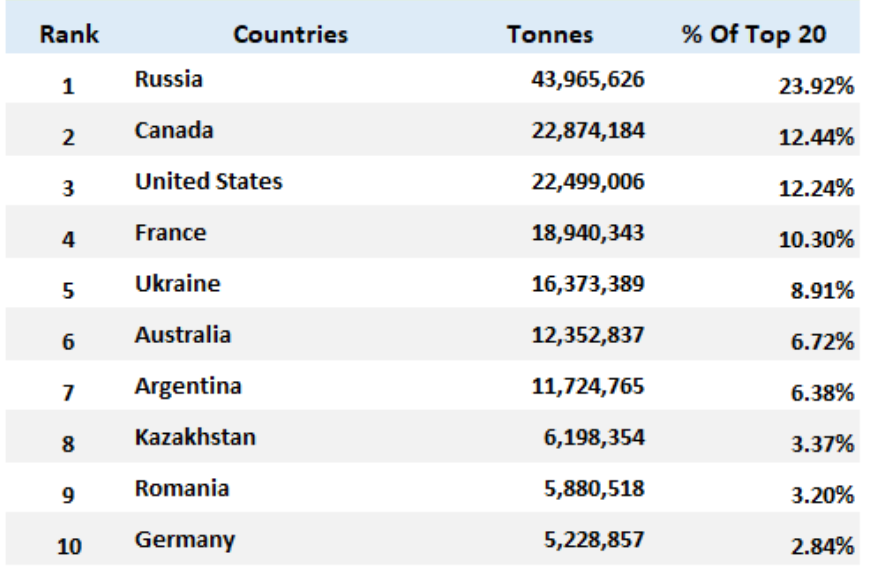

Oh wait, found it... https://beef2live.com/story-top-20-largest-wheat-exporters-world-0-206491

-

Oil since beginning of year (around 50% increase)

The world won't like 150 dollar barrel oil or more.

It is every cog in the machine, too, so consumers suffer the rise in cost at multiple levels.

If Russia was as big an exporter of crude as it is grain - in terms of proportion of total - things would go mental very quickly. Fortunately they're not OPEC.

-

Looking at Russia and Ukraine producing about 30% of the world's grain, might be time to get back on that carb-free diet

Scary shit, TBH. I follow a few Aussie farmers on Twitter and they're actually a bit torn on the morals of a higher grain price due to people dying in a shitty conflict...

-

-

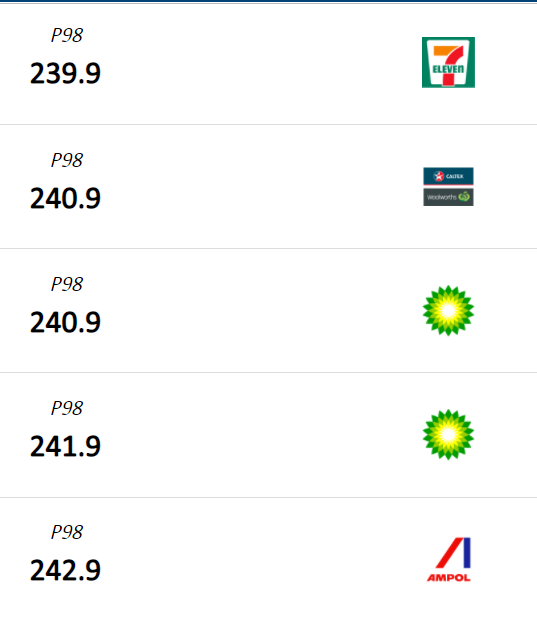

@booboo for premium or E10?

There is a BP near an Ampol the next suburb over - drove past last week with BP at $2.09 for E10 and Ampol $1.88

Traffic jam!

Actually not sure. Just noticed petrol prices at the servo at our favourite coffee drive through we're both under 2 (I.e., 199.9 & 195.9 - Can't remember which was which.) Was in the work ute (fuck using my own fuel) and am awaiting fuel card so wasn't filling up ... and it's diesel which was still well over 2.

-

Whilst those rationales my have some merit on the longer term oil price they have no real bearing on what has happened over the last month or so. We’ve seen oil going from under $100 to over $130 and back below $100 in less than 30 days. That has nothing to do with oil being more expensive to produce or the cost of capital to the industry. That is all to do with speculation based on fear of a supply chain problem.

-

@catogrande said in Inflation:

Whilst those rationales my have some merit on the longer term oil price they have no real bearing on what has happened over the last month or so. We’ve seen oil going from under $100 to over $130 and back below $100 in less than 30 days. That has nothing to do with oil being more expensive to produce or the cost of capital to the industry. That is all to do with speculation based on fear of a supply chain problem.

Yes, the recent spike, but the author is not talking about that, he's meaning the longer term rise which has been in effect since November 2020.

-

@catogrande said in Inflation:

Whilst those rationales my have some merit on the longer term oil price they have no real bearing on what has happened over the last month or so. We’ve seen oil going from under $100 to over $130 and back below $100 in less than 30 days. That has nothing to do with oil being more expensive to produce or the cost of capital to the industry. That is all to do with speculation based on fear of a supply chain problem.

Yes, the recent spike, but the author is not talking about that, he's meaning the longer term rise which has been in effect since November 2020.

One could actually argue slightly longer, from early 2020 when it bottomed out at less than $17 (a price not seen in the previous twenty years) but that would just be further cherry picking of data to support an argument. Similarly picking a date of late 2008 we can construct an argument of the systematic falling of oil prices from a high of around $145. Neither argument holds water.

Sure, he has a point that tightening of capital will have an effect on the ability for exploration but in truth cash-flow and therefore access to capital has not really been an issue, certainly for the larger companies, for a very long time. It may have an effect in the much longer term if that trend continues but currently the oil price is pretty much manipulated by the turning on or off of the taps by OPEC. Outside of that supply issue speculation, which is caused by fear and greed is the next biggest impact.

He's basically an advert for the oil industry.

-

@catogrande said in Inflation:

That is all to do with speculation based on fear of a supply chain problem.

From stolen elections, to white supremacist cops, to global pandemics and variants-du-jour, will-he-or-won’t-he employ mustard gas in Ukraine… our news industry seems to be composed almost entirely of nothing-but speculation based on fear. This is Who We Are.

-

@catogrande It's the Fern so obviously I didn't read the piece, but fracking?

Massive reason for the drop in oil prices. Us went from an importer to one of the biggest exporters. Cue legislative changes rising compliance costs. Also contributed to the rise. Not as much as the fall but still an influence.

I learned yesterday that the original Ford's were designed to run on petrol or alcohol. Ford let the market decide. Imagine the impact on drink driving

-

@kid-chocolate it's media, it's always been that way. 'if it bleeds, it leads'; no one cares about good news

Inflation