Rugby Finances

-

How about a dedicated thread for this stuff ....

RFU annual report out.

Steve Brown leaving.

This bit is interesting in light of valuations of the private equity trying to buy into premiership. RFU think their central payments are too expensive.

Cosslett did not mention Brexit but he did say the overall financial outlook was uncertain and the sports-rights market is tightening. But he also suggested that the RFU had overpaid when it signed a £200m, eight-year agreement with the professional clubs to compensate them for international call-ups.

“We have to accept we signed some long-term commitments with the professional game which, while strategically important, now appear costly against updated revenue forecasts … they will reduce our discretionary investment going forward,” wrote Cosslett.

-

£200m is a lot of money. Looking at Twickenham gate receipts and assuming an average of 7 England games a year, 82k crowd and an average of £80 a ticket, that’s around £46m from probably the second biggest revenue after sponsorship (well you’d hope so anyway). Sure there’s other earners but I’d have thought nothing quite do significant. Caveat here is that I’m thinking along the lines of what choices I have in paying for tickets and the reality may be different, plus there are also the beer sales and catering contracts - unlikely on their own to offset the gin bill though.

-

Further piece from the article;

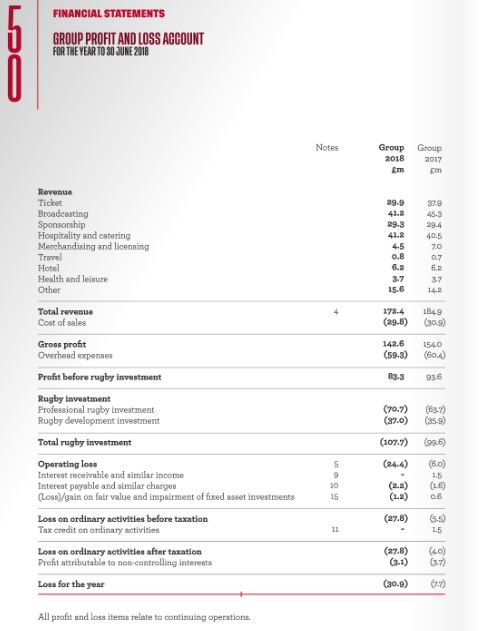

The Rugby Football Union has predicted “growing uncertainty” and “challenging times” after its annual accounts revealed a £30.9m loss and the forced redundancy of 54 staff members.

The RFU released its financial statement for the year ending 30 June 2018 on Monday, a 12 month-period that saw England’s form decline on the pitch and income fall by £12.5m. The current account deficit, however, was offset by a restructuring of the RFU’s Twickenham hospitality business joint venture with Compass. That brought in a one-off profit of £31.6m, enabling the union to increase its investment in the elite and grassroots games by 8% and top up its reserves to £25.1m.

Speaking on Monday, the chief executive, Steve Brown, insisted he was leaving his post, having announced he was doing so earlier this month, for his “own reasons” and not because the RFU is in bad financial shape.

I'm not sure what that means. Have they outsourced (sold) more of their match-day hospitality business? Meaning lower match-day revenue going forward for price of £31.6m now?

-

@catogrande said in Rugby Finances:

£200m is a lot of money. Looking at Twickenham gate receipts and assuming an average of 7 England games a year, 82k crowd and an average of £80 a ticket, that’s around £46m from probably the second biggest revenue after sponsorship (well you’d hope so anyway). Sure there’s other earners but I’d have thought nothing quite do significant. Caveat here is that I’m thinking along the lines of what choices I have in paying for tickets and the reality may be different, plus there are also the beer sales and catering contracts - unlikely on their own to offset the gin bill though.

From the horses mouth.

-

Hands up if THE Rugby Football Union’s financial situation is one of your most pressing concerns.

-

@billy-tell said in Rugby Finances:

Hands up if THE Rugby Football Union’s financial situation is one of your most pressing concerns.

Cue The Young Ones "Who Likes Rick?" moment

-

-

England should just build their own stadium.

-

-

With that announcement, NZRU are looking positively healthy at the moment as the second richest union in rugby.

Wales are starting to come good with the Millennium Stadium practically paid for with their sponsorship deal with Principality. They’ve started to invest a lot more in domestic pathways following the lead of IRFU a few years ago.

Unlike IRFU, WRU own their stadium outright. They’ll start to invest more in their regions, to allow them buy a few foreign players until they right the ship domestically. I can see a lot of upside in Welsh rugby over the next decade.

Scottish RU are more positive too but they still have problems with domestic playing population.

-

@machpants said in Rugby Finances:

FFS richest Union by miles and they still fuck it up. So just like Premierships clubs (outside of my team Exeter) they're living in a financial dream world. But they don't have some stupid rich person to use it for writing off tax with losses.

Yeah but nah. This is more temporary for the RFU.

A gold mine temporarily tightening it's belt due to executive blunders.The premiership clubs are a structural fantasyland. Well, 50 to 75% of them anyway. For whom the RFU are a source of 25 to 50% of their revenues. That's why I find the RFU revenues interesting as it trickles down to our annual exodus threads.

However the RFU and Premiership Rugby professional game agreement has 6 more years to run until 2024, so that source is pretty safe for the medium term. It will effect the league's valuation though, at a time when they are looking for private equity investment, to have a public announcement by the RFU that they think they've overpaid.

-

@derm-mccrum said in Rugby Finances:

With that announcement, NZRU are looking positively healthy at the moment as the second richest union in rugby.

Wales are starting to come good with the Millennium Stadium practically paid for with their sponsorship deal with Principality. They’ve started to invest a lot more in domestic pathways following the lead of IRFU a few years ago.

Unlike IRFU, WRU own their stadium outright. They’ll start to invest more in their regions, to allow them buy a few foreign players until they right the ship domestically. I can see a lot of upside in Welsh rugby over the next decade.

Scottish RU are more positive too but they still have problems with domestic playing population.

Yes, the "build a bigger stadium" theory is going to start paying off now for the WRU.

It's taken 20 years, and it nearly bankrupted them 5 years into the journey. The whole reason 'out of window' revenue sharing tests started was because the WRU were on the verge of bankruptcy due to their stadium debt.

-

England players’ £25,000 match fees may be cut to reduce RFU spending

Gerard Meagher

England players’ £25,000 match fees may take a hit in the future, according to the Rugby Football Union’s departing chief executive, Steve Brown, after the governing body announced a loss of £30.9m on Monday.

Brown also admitted that an overspend on the England squad, largely as a result of a high turnover of players rather than staff, had contributed to the union’s financial plight. The RFU also expressed a degree of regret over the high cost of its £220m deal with Premiership clubs which guarantees Eddie Jones access to his players in the first place.

“We have an affordable position with the [payment] of England players and we need to make sure that is sustainable for the future,” said Brown. “That’s key, we need to make sure there’s a sustainable model that keeps the players safe and fit and well, well-paid for what they do but also operating a commercially sound and stable business. The market determines that to a certain extent, but the next phase we’re going through, with some of the wider challenges affecting us, will start to level that [out] a bit.”

The eight-year Professional Game Agreement (PGA), signed in 2016, guarantees Jones access to his squad but the RFU chairman, Andy Cosslett, on Monday acknowledged the role it has played in leading to the union’s loss, published in its annual accounts up to June 2018.

“We have to accept that over recent years we signed some long-term agreements with the professional game which, while strategically important, now appear costly against updated revenue forecasts,” Cosslett said. “This will restrict our discretionary investment capacity going forward.”

The accounts also show that the former chief executive, Ian Ritchie, who brokered the PGA, was paid £238,000 for his final two months in the job last year, despite the union being forced to make 54 redundancies. The RFU says the payment to Ritchie, who left the union in August 2017 and is now chairman of Premiership Rugby, was salary owed as well as additional amount in lieu of a full notice period as a contractual obligation.

Of the job losses – 62 roles were made redundant with 54 employees leaving the union – Cosslett added: “We’ve had to throttle back and sadly that involves some redundancies and restructuring. It’s important we have a stable outlook which reflects our updated revenue forecasts.”

In September Ritchie was succeeded by Brown, who announced this month he is also leaving his £400,000-a-year position after just 14 months amid accusations from RFU grandees of mismanaging the union’s finances, but the departing chief executive has stated England’s budget for the World Cup is ringfenced.

“[Overspending] did happen but we have got control of it and everyone is clear about that, from Eddie and his team downwards,” Brown added. “Sometimes through injury or trying different players out we need to select more players in a series. It’s just the way that the model works. It can work for us and sometimes it works against us financially.”

The overspend of around £40m on Twickenham’s revamped East Stand has also been identified as a contributing factor to union’s harsher economic outlook but while its borrowing limit has risen to £100m, the RFU insists it is on sound financial footing, stating that a one-off cash injection means it has effectively broken even.

The Twickenham Experience Limited hospitality business has been sold to Compass PLC for £31.6m, thereby boosting the RFU’s reserve fund, but Brown denied the RFU is “moving money around” to hide the £30.9m deficit. The RFU is also anticipating a profit for 2018-19.

The accounts also show that the RFU invested £107.7m of its revenue back into the sport, an increase of 8%, but its annual income fell £12.5m, largely due to hosting fewer Tests at Twickenham as well as England’s fifth-place finish in this year’s Six Nations.

Cosslett did confirm, however, that England’s upturn in form this autumn means Jones’s job is safe through to the World Cup. “The performance in the autumn was extremely good, and that discussion – if it was there recently – has certainly evaporated now,” he said. “The World Cup is a very significant focus for us and our priority one right now. It’s absolutely clear where the costs are leading up to the World Cup and we will be making sure that is safeguarded going into the World Cup because we want to win it.”

-

@machpants said in Rugby Finances:

Compass took over military catering during my time and they were fucking abysmal. Probably made a good profit off the shit they did in the mess.

Why would the military outsource catering?

-

@nepia said in Rugby Finances:

@machpants said in Rugby Finances:

Compass took over military catering during my time and they were fucking abysmal. Probably made a good profit off the shit they did in the mess.

Why would the military outsource catering?

Save money. Australian Defence Force did the same. All of a sudden there was a limit on the amount of steak I could eat for dinner. No loading up on other meat either.

-

@antipodean said in Rugby Finances:

@nepia said in Rugby Finances:

@machpants said in Rugby Finances:

Compass took over military catering during my time and they were fucking abysmal. Probably made a good profit off the shit they did in the mess.

Why would the military outsource catering?

Save money. Australian Defence Force did the same. All of a sudden there was a limit on the amount of steak I could eat for dinner. No loading up on other meat either.

Seems weird from a logistical point of view. I thought they'd still be training up cooks etc. I have a couple of cousins who went into the army to kick start their chef careers back in the 90s and now work in poxy places in London/New York.

-

Then the serving caterers (insert any role that can be civilianised at home, engineers, police, medical, etc) get more and more deployments, ruining their family lives, so they quit. Then you have to train up replacements, costing way more money than you saved with civilian contracting, whilst also having reduced quality of service, and everyone's job satisfaction. Thanks fucking bean counters