-

[edit]Split from another thread[/edit]

Australians don't know how good they have it. 4 weeks annual leave, 13 Public Holidays (VIC) 10.5% super on top of your base wage. No tax on first $18,200, no secondary job tax, 10 days sick leave, up to 18 weeks parental leave.

So in theory if you work full time, you can legally get 43 paid days off a year or basically two months.

And if you are in certain public service jobs your work week is 35 hours.

Granted there are a lot of issues in Australia but days off is clearly not one of them.

-

@chimoaus said in The hot takes and unpopular opinions:

Australians don't know how good they have it. 4 weeks annual leave, 13 Public Holidays (VIC) 10.5% super on top of your base wage. No tax on first $18,200, no secondary job tax, 10 days sick leave, up to 18 weeks parental leave.

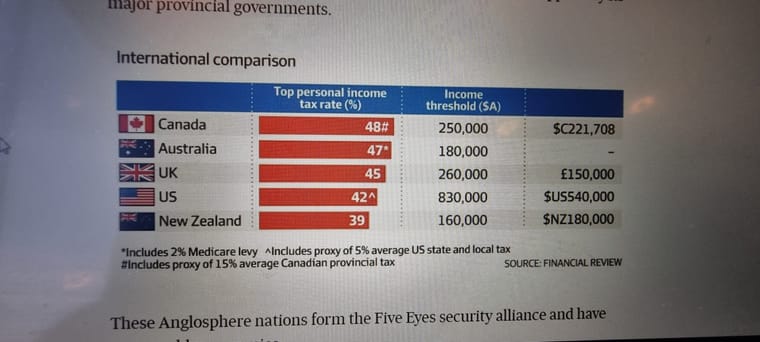

NZ is 4 weeks mandatory, 11 days public holidays. NZ Super rather than the funded scheme, and taxes up the wazoo. So comparable in terms of leave, but paid less and things cost more.

Edit: and higher taxes for a bunch of the tax bands too. Anyone know the GST comparison?

Edit 2: and hot take: I'd still rather live in NZ

-

@nzzp said in The hot takes and unpopular opinions:

@chimoaus said in The hot takes and unpopular opinions:

Australians don't know how good they have it. 4 weeks annual leave, 13 Public Holidays (VIC) 10.5% super on top of your base wage. No tax on first $18,200, no secondary job tax, 10 days sick leave, up to 18 weeks parental leave.

NZ is 4 weeks mandatory, 11 days public holidays. NZ Super rather than the funded scheme, and taxes up the wazoo. So comparable in terms of leave, but paid less and things cost more.

Edit: and higher taxes for a bunch of the tax bands too. Anyone know the GST comparison?

Edit 2: and hot take: I'd still rather live in NZ

we get drilled here in Oz on tax - for the same comparable health / infra benefits. GST is low at 10%, should be way higher and personal tax rates should be way lower

-

@chimoaus said in The hot takes and unpopular opinions:

Australians don't know how good they have it. 4 weeks annual leave, 13 Public Holidays (VIC) 10.5% super on top of your base wage. No tax on first $18,200, no secondary job tax, 10 days sick leave, up to 18 weeks parental leave.

So in theory if you work full time, you can legally get 43 paid days off a year or basically two months.

And if you are in certain public service jobs your work week is 35 hours.

Granted there are a lot of issues in Australia but days off is clearly not one of them.

The problem is no PHs until xmas - they're concentrated in the first half of the year and should be spaced out.

-

@voodoo said in The hot takes and unpopular opinions:

@nzzp said in The hot takes and unpopular opinions:

@chimoaus said in The hot takes and unpopular opinions:

Australians don't know how good they have it. 4 weeks annual leave, 13 Public Holidays (VIC) 10.5% super on top of your base wage. No tax on first $18,200, no secondary job tax, 10 days sick leave, up to 18 weeks parental leave.

NZ is 4 weeks mandatory, 11 days public holidays. NZ Super rather than the funded scheme, and taxes up the wazoo. So comparable in terms of leave, but paid less and things cost more.

Edit: and higher taxes for a bunch of the tax bands too. Anyone know the GST comparison?

Edit 2: and hot take: I'd still rather live in NZ

we get drilled here in Oz on tax - for the same comparable health / infra benefits. GST is low at 10%, should be way higher and personal tax rates should be way lower

The peasants scream when you suggest that.

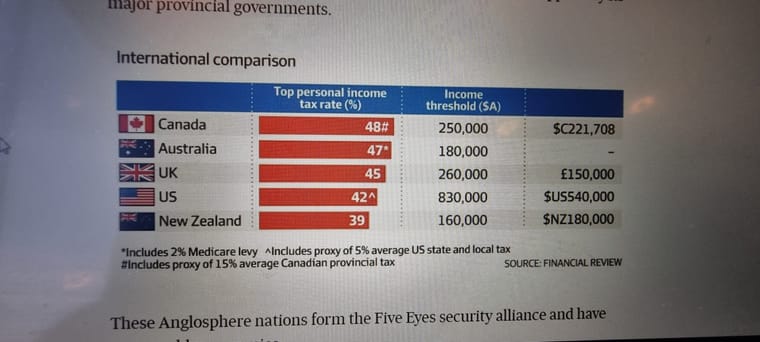

This tells the story, but if they could comprehend it, they'd probably be earning more:

-

@antipodean does that include GST? And State taxes?

-

@Crucial said in The hot takes and unpopular opinions:

@antipodean does that include GST? And State taxes?

Reckon that's just contribution via PAYG. Not GST. We don't have state taxes per se

-

@voodoo said in The hot takes and unpopular opinions:

@Crucial said in The hot takes and unpopular opinions:

@antipodean does that include GST? And State taxes?

Reckon that's just contribution via PAYG. Not GST. We don't have state taxes per se

I meant State taxes as in 'things you will have to pay to live' - like GST.

But anyway if it is straight income tax then I'm not quite sure of the purpose of the picture except to show that stats can be deceiving. -

@Crucial said in The hot takes and unpopular opinions:

@voodoo said in The hot takes and unpopular opinions:

@Crucial said in The hot takes and unpopular opinions:

@antipodean does that include GST? And State taxes?

Reckon that's just contribution via PAYG. Not GST. We don't have state taxes per se

I meant State taxes as in 'things you will have to pay to live' - like GST.

But anyway if it is straight income tax then I'm not quite sure of the purpose of the picture except to show that stats can be deceiving.Well the GST is the same in every state. The graphic is just showing how much of your take-home pay goes straight to the Feds.

Seems to me that showing that 3% of people pay 30% of the tax take is something of significance? -

@voodoo said in The hot takes and unpopular opinions:

@Crucial said in The hot takes and unpopular opinions:

@voodoo said in The hot takes and unpopular opinions:

@Crucial said in The hot takes and unpopular opinions:

@antipodean does that include GST? And State taxes?

Reckon that's just contribution via PAYG. Not GST. We don't have state taxes per se

I meant State taxes as in 'things you will have to pay to live' - like GST.

But anyway if it is straight income tax then I'm not quite sure of the purpose of the picture except to show that stats can be deceiving.Well the GST is the same in every state. The graphic is just showing how much of your take-home pay goes straight to the Feds.

Seems to me that showing that 3% of people pay 30% of the tax take is something of significance?Do 3% of the people earn 3% of the income?

Can't ignore consumption taxes either as the lower the earnings the more of it has to be consumed.

Totally get your point that brackets or marginal points should move with cost of living otherwise the orginal calcs were either not done on any basis of 'fairness' and/or over time the total take increases. -

The country is too dependent on redistributing income, to the point one fifth of the nation provides two-thirds of the income tax. And people still have the gall to complain about the "rich getting tax cuts".

-

@Crucial said in The hot takes and unpopular opinions:

Can't ignore consumption taxes either as the lower the earnings the more of it has to be consumed.

Except housing often makes up a larger proportion of spend for lower incomes - and that doens't strictly catch a GST type tax (rent)

-

@antipodean said in The hot takes and unpopular opinions:

The country is too dependent on redistributing income, to the point one fifth of the nation provides two-thirds of the income tax. And people still have the gall to complain about the "rich getting tax cuts".

All I am saying is that the charts would argue you case better if they showed amount earned vs amount paid. Head count is rather irrelevant. It is pretty expected that 10 people earning $100 would pay less tax than one earning $10,000 even with a flat tax. Would you then argue that they aren't paying their share?

-

@Crucial said in The hot takes and unpopular opinions:

@antipodean said in The hot takes and unpopular opinions:

The country is too dependent on redistributing income, to the point one fifth of the nation provides two-thirds of the income tax. And people still have the gall to complain about the "rich getting tax cuts".

All I am saying is that the charts would argue you case better if they showed amount earned vs amount paid. Head count is rather irrelevant. It is pretty expected that 10 people earning $100 would pay less tax than one earning $10,000 even with a flat tax. Would you then argue that they aren't paying their share?

Half of Australians pay no net tax. That alone tells a compelling story - their lives are being subsidised by others which is fine, it's the real lack of acknowledgment that's my bugbear. Particularly in the toxic discussion of the phase three tax cuts.

-

@antipodean said in Tax rates:

The country is too dependent on redistributing income, to the point one fifth of the nation provides two-thirds of the income tax. And people still have the gall to complain about the "rich getting tax cuts".

The UK says hold my beer ....

When the AUD tanks & people start shedding Aussie government bonds because the Chancellor drops the top tax rate, then I'll appreciate your whinge!

Reality is that "the people" have gotten used to doing less (due to Covid) and being compensated by the Government for it. It's a long rough road ahead.

-

Good listen. Not too dumbed down, just need to get past the brackets explanation ...

Those bracket thresholds are unmoved since 2010.

-

@MajorRage said in Tax rates:

@antipodean said in Tax rates:

The country is too dependent on redistributing income, to the point one fifth of the nation provides two-thirds of the income tax. And people still have the gall to complain about the "rich getting tax cuts".

The UK says hold my beer ....

When the AUD tanks & people start shedding Aussie government bonds because the Chancellor drops the top tax rate, then I'll appreciate your whinge!

Reality is that "the people" have gotten used to doing less (due to Covid) and being compensated by the Government for it. It's a long rough road ahead.

I feel the UK will impact a lot the decisions other governments, like ours, will make. Certainly the incumbent govts anyway, rather than oppositions. Will go cautious.

-

Any suggestions on which country has the best tax system? Has any country worked out a way to get a portion of the profits from the really big businesses? I can't help but wonder how we get so many uber wealthy individuals and companies and why more of their wealth has not been redistributed.

Tax rates