-

https://www.stuff.co.nz/business/110677332/biggest-tax-shakeup-for-a-generation

Best time to do this while they are polling so well compared to previous years. I'm not smiling though.

-

they get you one way or another.

Not sure if they still have ISA's in the UK, but NZ really needs something similar to encourage savings, reduce or remove KIwisaver tax (guess it'd be too complicated to tax just on the gains made from Govt. contributions)

-

Feels like something has to change, even if it's going to be hard. I do like their focus on keeping it as simple as possible. But that opens them up for criticism that it's not nuanced enough, or too crude.

If it makes it through do we think National will kill it immediately upon returning to office as they are saying? Or instead might retain it but make changes?

In an odd way this feels like our version of the USA's healthcare dilemma/firestorm. Emotive (and real world impact) stuff for sure!

-

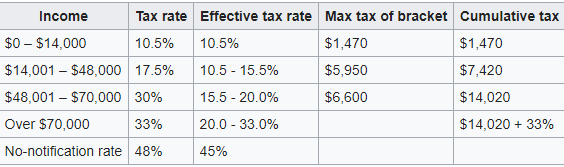

alot of the focus is on CGT, when it should be about adjusting all the tax brackets, given a good portion of 'middle income' NZ is in the top tax bracket.

-

That bottom bracket should just go. It brings in FA tax in the wider scheme of things but for those that genuinely struggle it would make a difference.

I cannot fathom why successive governments have ignored this.

I'd far rather have seen cross party cooperation on CGT like there should be on Super as effectively the issues are linked. Instead it's bound to be a political football.

-

@dogmeat said in So we are about to get taxed up a storm!:

That bottom bracket should just go. It brings in FA tax in the wider scheme of things but for those that genuinely struggle it would make a difference.

I cannot fathom why successive governments have ignored this.

I'd far rather have seen cross party cooperation on CGT like there should be on Super as effectively the issues are linked. Instead it's bound to be a political football.

I hope Labour really hitch their wagon to CGT, it will cost them the next election.

-

@dogmeat said in So we are about to get taxed up a storm!:

@Kirwan oh I agree that in all probability that'll be the outcome.

I'm for a consensus approach for the likes of you and your kids. I'm close enough to retirement to be a largely disinterested observer.

I'm fully expecting the top tax rate to go up as well. Politics of envy...

-

@Kirwan said in So we are about to get taxed up a storm!:

@dogmeat said in So we are about to get taxed up a storm!:

That bottom bracket should just go. It brings in FA tax in the wider scheme of things but for those that genuinely struggle it would make a difference.

I cannot fathom why successive governments have ignored this.

I'd far rather have seen cross party cooperation on CGT like there should be on Super as effectively the issues are linked. Instead it's bound to be a political football.

I hope Labour really hitch their wagon to CGT, it will cost them the next election.

Not if they up their flow of Neve pics into MSM

-

@canefan said in So we are about to get taxed up a storm!:

@Kirwan said in So we are about to get taxed up a storm!:

@dogmeat said in So we are about to get taxed up a storm!:

That bottom bracket should just go. It brings in FA tax in the wider scheme of things but for those that genuinely struggle it would make a difference.

I cannot fathom why successive governments have ignored this.

I'd far rather have seen cross party cooperation on CGT like there should be on Super as effectively the issues are linked. Instead it's bound to be a political football.

I hope Labour really hitch their wagon to CGT, it will cost them the next election.

Not if they up their flow of Neve pics into MSM

People are easy to distract right up until you put your hand in their pockets.

Something else for you all to clarify, CGT exempts the family home. What about when you die, is it still the family home? Or does this turn into a stealth death tax as well?

-

should be no tax payable on income under $20k, the low bracket should be upto $50k, the next $50k-$80k, 30% should be $80k-$120k and then the 33% for $120k+

All those in the 0 tax bracket will just give it back to the Govt. in GST anyway.

-

@Kirwan said in So we are about to get taxed up a storm!:

@canefan said in So we are about to get taxed up a storm!:

@Kirwan said in So we are about to get taxed up a storm!:

@dogmeat said in So we are about to get taxed up a storm!:

That bottom bracket should just go. It brings in FA tax in the wider scheme of things but for those that genuinely struggle it would make a difference.

I cannot fathom why successive governments have ignored this.

I'd far rather have seen cross party cooperation on CGT like there should be on Super as effectively the issues are linked. Instead it's bound to be a political football.

I hope Labour really hitch their wagon to CGT, it will cost them the next election.

Not if they up their flow of Neve pics into MSM

People are easy to distract right up until you put your hand in their pockets.

Something else for you all to clarify, CGT exempts the family home. What about when you die, is it still the family home? Or does this turn into a stealth death tax as well?

I'm sure there will be lots of blue sky talk and little detail

-

They are painting the CGT all wrong by claiming it will help reduce the gap bewteen 'rich and poor' because by saying it like that, it is just bringing the top down, rather than more importantly bringing those that work or cant due to accident/injury/illness at the bottom up (despite the fact the lazy fucks will benefit too)

-

@taniwharugby said in So we are about to get taxed up a storm!:

They are painting the CGT all wrong by claiming it will help reduce the gap bewteen 'rich and poor' because by saying it like that, it is just bringing the top down, rather than more importantly bringing those that work or cant due to accident/injury/illness at the bottom up (despite the fact the lazy fucks will benefit too)

They would be better off saying they want to try to lessen Kiwi's over-investment in property in favour of other investment vehicles

-

@canefan plenty of better ways to paint it rather than take money from the hard working and yes some rich to simply make them closer to the poor (even if only a little bit in many cases)

I was talking to a guy last week, he was saying his son owns >100 houses in Auckland.

-

Government has a shit load of work to do before anything happens. 1 April 2021 is a real challenge unless they go with a simplified approach.

Good summary available at https://www.pwc.co.nz/pdfs/tax-tips/tax-tips-february-2019.pdf

-

@taniwharugby said in So we are about to get taxed up a storm!:

should be no tax payable on income under $20k, the low bracket should be upto $50k, the next $50k-$80k, 30% should be $80k-$120k and then the 33% for $120k+

All those in the 0 tax bracket will just give it back to the Govt. in GST anyway.

They did consider a zero tax bracket but not alot of people actually stay in there. Most transition through so thought was to increase the top end of that lower bracket as a way to provide more relief at that point

So we are about to get taxed up a storm!